It's great to compare debt ratios across companies; however, capital intensity and debt needs vary widely across sectors. The financial health of a firm may not be accurately represented by comparing debt ratios across industries. Bear in mind how certain industries may necessitate higher debt ratios due to the trump proposes eliminating payroll tax through the end of the year initial investment needed. A debt ratio of 30% may be too high for an industry with volatile cash flows, in which most businesses take on little debt. A company with a high debt ratio relative to its peers would probably find it expensive to borrow and could find itself in a crunch if circumstances change.

How to Compute Debt to Equity Ratio

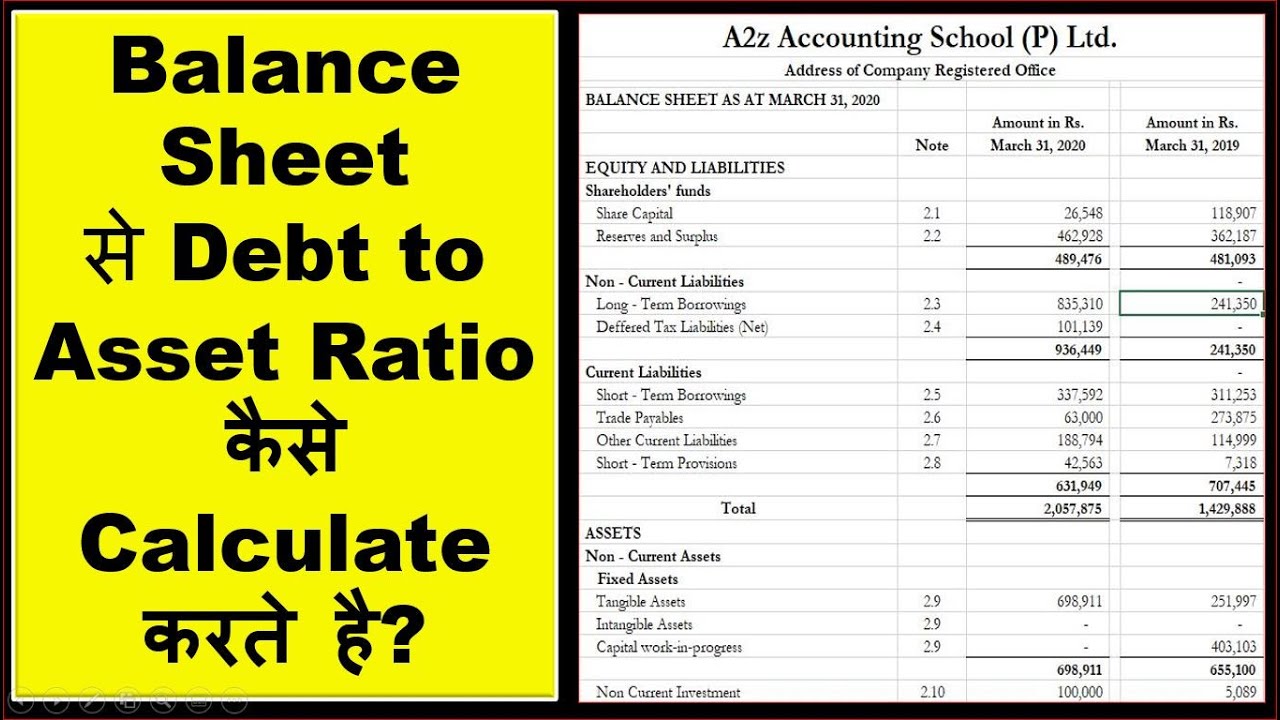

Microsoft Excel provides a balance sheet template that automatically calculates financial ratios such as the D/E ratio and the debt ratio. An ideal ratio varies by industry, but a range between 40% and 60% is typically considered moderate. Some industries may sustain higher ratios, depending on their asset base and cash flow stability. Business debt, or liability, is anything that you owe or anything that’s unpaid.

How Can the D/E Ratio Be Used to Measure a Company’s Riskiness?

Interest payments on debt are tax-deductible, which means that the company can reduce its taxable income by deducting the interest expense from its operating income. The debt capital is given by the lender, who only receives the repayment of capital plus interest. Whereas, equity financing would entail the issuance of new shares to raise capital which dilutes the ownership stake of existing shareholders. Assessing whether a D/E ratio is too high or low means viewing it in context, such as comparing to competitors, looking at industry averages, and analyzing cash flow. They do so because they consider this kind of debt to be riskier than short-term debt, which must be repaid in one year or less and is often less expensive than long-term debt. When interpreting the D/E ratio, you always need to put it in context by examining the ratios of competitors and assessing a company's cash flow trends.

- The D/E ratio is a powerful indicator of a company’s financial stability and risk profile.

- Generally speaking, short-term liabilities (e.g. accounts payable, wages, etc.) that would be paid within a year are considered less risky.

- Generally, a ratio below 1 is considered safer, while a ratio above 2 might indicate higher financial risk.

- On the other hand, companies with low debt-to-equity ratios aren’t always a safe bet, either.

- For example, a company may not borrow any funds to support business operations, not because it doesn’t need to but because it doesn’t have enough capital to repay it promptly.

- A high Debt to Equity ratio can lead to increased interest expenses and financial instability.

Sports & Health Calculators

A negative D/E ratio indicates that a company has more liabilities than its assets. This usually happens when a company is losing money and is not generating enough cash flow to cover its debts. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations. However, industries may have an increase in the D/E ratio due to the nature of their business.

Its debt-to-equity ratio would therefore be $1.2 million divided by $800,000, or 1.5. The concept of comparing total assets to total debt also relates to entities that may not be businesses. For example, the United States Department of Agriculture keeps a close eye on how the relationship between farmland assets, debt, and equity change over time.

Important Considerations about Debt to Asset Ratio

Some industries, such as banking, are known for having much higher debt-to-equity ratios than others. So if a company has total assets of $100 million and total debt of $30 million, its debt ratio is 0.3 or 30%. Is this company in a better financial situation than one with a debt ratio of 40%?

Assume a company has $100,000 of bank lines of credit and a $500,000 mortgage on its property. A debt-to-equity ratio of 1.5 would indicate that the company in question has $1.50 of debt for every $1 of equity. To illustrate, suppose the company had assets of $2 million and liabilities of $1.2 million. Since equity is equal to assets minus liabilities, the company’s equity would be $800,000.

It is important to note that the D/E ratio is one of the ratios that should not be looked at in isolation but with other ratios and performance indicators to give a holistic view of the company. If the D/E ratio gets too high, managers may issue more equity or buy back some of the outstanding debt to reduce the ratio. Conversely, if the D/E ratio is too low, managers may issue more debt or repurchase equity to increase the ratio. Managers can use the D/E ratio to monitor a company's capital structure and make sure it is in line with the optimal mix.

The current ratio measures the capacity of a company to pay its short-term obligations in a year or less. Analysts and investors compare the current assets of a company to its current liabilities. Basically, the more business operations rely on borrowed money, the higher the risk of bankruptcy if the company hits hard times.

That makes debt an attractive way to fund business, especially compared to the potential returns from the stock market, which can be volatile. The debt-to-equity ratio can clue investors in on how stock prices may move. As a measure of leverage, debt-to-equity can show how aggressively a company is using debt to fund its growth.